With a market capitalization of $10.9 billion, FactSet Research Systems Inc. (FDS) is a global financial data and analytics company that provides investment professionals with integrated market data, research, portfolio analytics, and workflow solutions. Founded in 1978 and headquartered in Connecticut, FactSet operates a subscription-based model with high client retention, serving asset managers, banks, hedge funds, and corporations worldwide.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and FDS fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the financial sector.

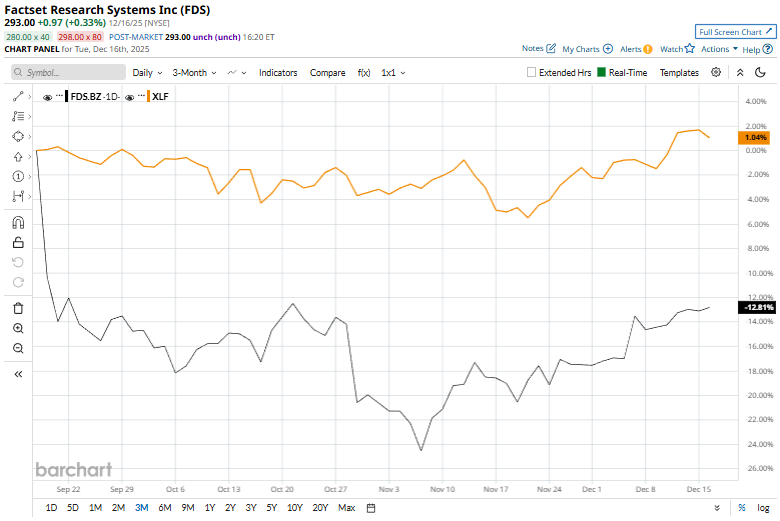

Despite its strong market position, FactSet’s stock performance has been notably weak. Shares have fallen 41% from their 52-week high of $496.90, reflecting sustained selling pressure. FDS stock has dropped 15.1% over the past three months, underperforming the Financial Select Sector SPDR Fund’s (XLF) 2% rise during the same period.

The underperformance is more pronounced over longer horizons. FDS has declined 39.9% over the past year and 30.5% in the last six months, while XLF advanced 10.5% over 52 weeks and 8.1% over six months.

From a technical perspective, the stock has remained below its 200-day moving average since early June, though a recent move above the 50-day moving average suggests early signs of short-term stabilization.

.

On Dec. 4, FactSet announced that its market intelligence is now available through Amazon Quick Research, enabling clients to integrate FactSet data with their AWS cloud environments seamlessly. Designed for enterprise AI leaders, the solution streamlines research workflows by eliminating manual data uploads and supporting AI-driven strategies. The move reinforces FactSet’s focus on cloud- and AI-ready offerings, allowing existing subscribers to access the service immediately. FDS shares rose more than 4% in the next trading session.

By comparison, its rival S&P Global Inc. (SPGI) has seen only a marginal decline over the past year and a 1% dip over the past six months, highlighting FDS’ relative underperformance in the market.

Analysts remain cautious on the stock’s long-term trajectory. Among 19 covering analysts, the consensus rating is a “Hold.” FDS has a mean price target of $322.07, reflecting a premium of 9.9% to current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Growth Stock With 137% Upside Faces New Challenge: Buy, Hold or Sell?

- How to Buy CSCO for a 2.5% Discount, or Achieve a 19% Annual Return

- S&P Futures Gain as Investors Weigh U.S. Jobs Data, Fed Speak and Micron Earnings in Focus

- This High-Yield Dividend Stock Trades at a Third of Its Record Highs: Is It a Buy for 2026?