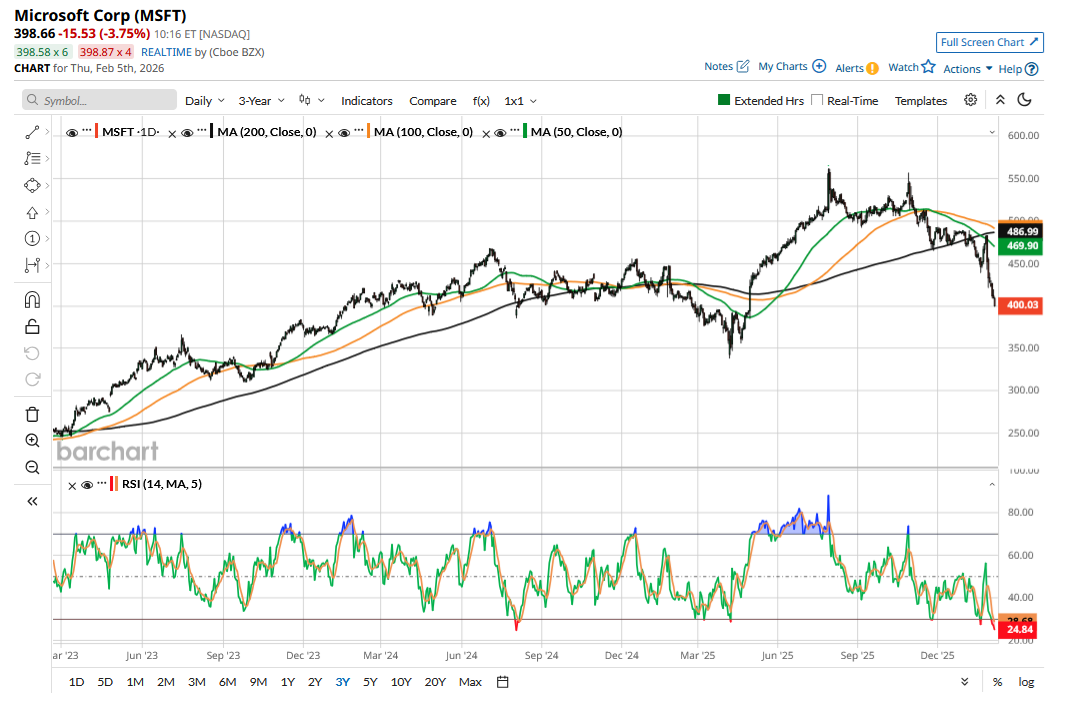

Things haven’t been pleasant for Microsoft (MSFT) investors over the last couple of years, as the company underperformed Big Tech peers in both 2024 and 2025. This year is looking no better, and MSFT stock is down around 17% for the year. In absolute terms, the stock, which peaked around $555 last year, is now close to $400 price levels, and its market cap is around $3 trillion.

Microsoft’s woes intensified after the company released its earnings for the December quarter last week. While the company beat on headline numbers, the report got a thumbs down from markets, and MSFT stock plunged by nearly 10%, eroding over $350 billion in market cap in a single day.

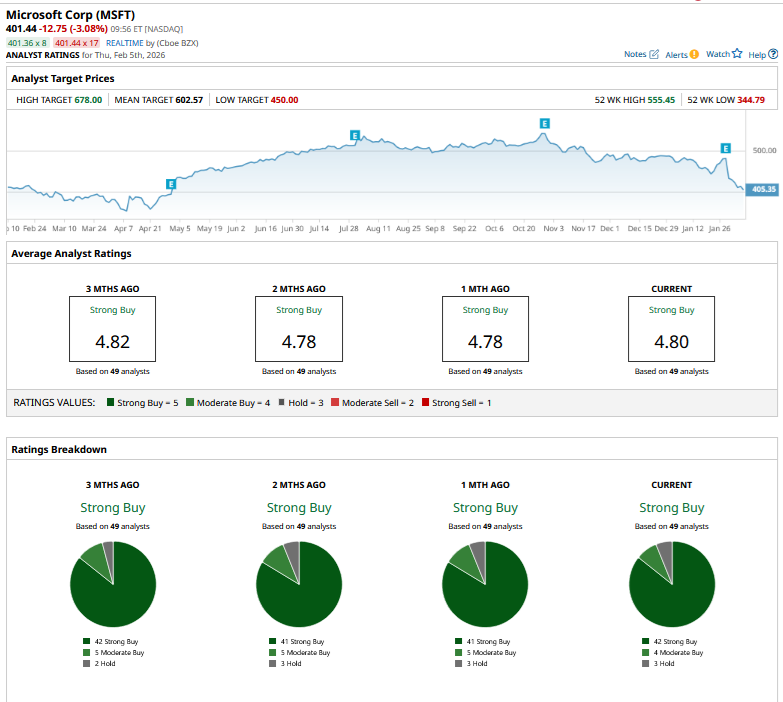

Following the fiscal Q2 2026 earnings report, several analysts lowered their target prices, but the stock’s mean target price is still above $600 and represents a potential upside of around 50% from these levels. Let's explore whether MSFT stock can rise above $600 over the next year, as many sell-side analysts seem to believe, or if it is headed for another dismal year. We'll begin with an overview of its earnings.

Why Microsoft’s Fiscal Q2 Earnings Spooked Investors

The Satya Nadella-led company beat on both the top line and the bottom line in the December quarter. However, its earnings still spooked markets for more than one reason. These include:

- AI Spending Spree: Like fellow Big Tech peers, Microsoft is doubling down on artificial intelligence (AI) spending, and its capex was $37.5 billion in the quarter, of which two-thirds are short-lived assets. For context, the quarterly capex was more than the annual capex in fiscal year 2023. There are lingering concerns over tech companies’ ability to adequately monetize these investments, which are draining their cash flows. Specifically, Microsoft’s free cash flows fell to $5.9 billion in the quarter.

- Slowing Cloud Growth: Microsoft’s total cloud revenues rose 26% to $51.5 billion, marking the first time the metric topped $50 billion in a single quarter. Azure reported a 39% growth in revenues, which was below the 40% that the company reported in the fiscal first quarter and slightly below Street estimates. The guidance for the current quarter implies a further tapering of growth. However, the company has argued that it is capacity-constrained in data center infrastructure and has been balancing in-house needs with external customers

- RPO Concentration: While Microsoft said that its cloud remaining performance obligations (RPOs) more than doubled year-over-year to $625 billion, it disclosed that nearly 45% of these came from OpenAI. Markets were spooked by the concentration risk in Microsoft’s RPOs and are particularly worried about OpenAI’s ability to deliver on its massive commitments. The ChatGPT parent has been facing stiff competition from Alphabet (GOOG) (GOOGL) and Anthropic, which have raised their game. To meet the commitment, OpenAI would need to raise billions more over the next couple of years, as I don’t see the possibility of the company doing so with its own revenues, however fast they are growing.

MSFT Stock Forecast

Microsoft’s valuations have plummeted amid the slide in its share price, and the stock now trades at a forward price-to-sales multiple of 8.78x, which is the lowest since mid-2023, when the rally in AI stocks was about to begin. The forward price-to-earnings (P/E) multiple has also fallen to around 26x, which looks quite attractive to me.

Microsoft’s recent price action has been intertwined with developments related to OpenAI, as the company is a proxy play on the world’s most valuable startup, owning over a quarter of the stake.

All said, I find MSFT stock quite attractive here. It is a defensive play that might gain favor with the markets amid the recent risk-off environment. From a fundamental perspective, Microsoft’s Windows and Office business would continue to benefit from the uptick in PC sales, led by an aging base of installed devices and the advent of AI PCs. LinkedIn also continues to grow in low double digits, and while there has been a slight deceleration in Azure growth, it looks more like a supply-side issue rather than a demand shortfall. An eventual listing of OpenAI could help Microsoft monetize its stake, even though I expect the company to remain a significant shareholder given the mutually beneficial partnership.

Overall, I find MSFT stock quite attractive near these levels, and given the tepid valuations and reasonably strong growth outlook, I won’t be surprised if the stock rises above $600 over the next two years.

On the date of publication, Mohit Oberoi had a position in: MSFT , GOOG . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nio Says Profitability Is Just Around the Corner. Should You Buy NIO Stock Here?

- As Analysts Forecast 50% Upside, Is Now the Time to Buy the Dip in AMD?

- Is There a Light at the End of the Tunnel for Qualcomm Stock? What Options Data, Technicals Tell Us.

- This Overlooked Biotech Giant Could Surprise Investors This Quarter