Shell plc (SHEL)

78.77

+0.00 (0.00%)

NYSE · Last Trade: Feb 17th, 8:08 AM EST

As of February 16, 2026, the global energy market finds itself trapped in a violent "tug-of-war" between gravity-defying geopolitical tensions and a relentless structural supply glut. While the International Energy Agency (IEA) has sounded the alarm on a massive projected surplus of nearly 4 million barrels per day (bpd) for

Via MarketMinute · February 16, 2026

As of today, February 16, 2026, the semiconductor industry is witnessing a historic shift, and at the epicenter of this transformation sits Applied Materials, Inc. (Nasdaq: AMAT). Known as the "pick-and-shovel" provider for the digital age, Applied Materials has recently captured the market's full attention following a stunning Q1 2026 earnings report that sent its [...]

Via Finterra · February 16, 2026

Shell PLC (NYSE:SHEL) Presents a Compelling Case for Quality Dividend Investorschartmill.com

Via Chartmill · February 10, 2026

The Treasury Department on Friday issued a general license allowing certain large oil companies to invest in new oil-and-gas operations in the Latin American country.

Via Stocktwits · February 13, 2026

NEW YORK — The American consumer engine, long the primary thruster of global economic growth, appears to have sputtered to a complete halt at the close of 2025. In a highly anticipated data release this week that was delayed nearly two months by a historic federal government shutdown, the U.S.

Via MarketMinute · February 13, 2026

As of February 12, 2026, the financial markets are witnessing a dramatic reversal of the decade-long "growth over value" narrative. In the first six weeks of the year, the S&P 500 Energy sector has surged to become the market's undisputed leader, posting a gain of over 14% and significantly

Via MarketMinute · February 12, 2026

As of February 11, 2026, the global energy landscape is teetering on the edge of a significant supply disruption following a series of aggressive maritime interdictions by the United States. On February 9, US naval forces successfully boarded and seized the Aquila II, a crude oil tanker allegedly part of

Via MarketMinute · February 11, 2026

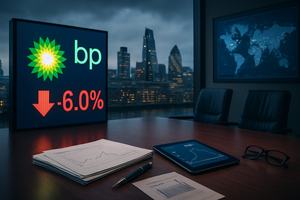

In a move that sent ripples through the global energy sector, BP (NYSE: BP) announced on February 10, 2026, that it would immediately suspend its $750 million quarterly share buyback program. The decision marks a dramatic departure from the company’s recent strategy of aggressive shareholder returns, signaling a pivot

Via MarketMinute · February 10, 2026

As of February 10, 2026, the global energy landscape finds itself at a crossroads between the urgent demands of decarbonization and the immediate realities of energy security. At the heart of this tension stands BP p.l.c. (NYSE: BP, LSE: BP), a company that has spent the last five years attempting one of the most ambitious [...]

Via Finterra · February 10, 2026

Via MarketBeat · February 9, 2026

The global energy market has been jarred by a "violent reversal" in crude oil prices during the first week of February 2026. After a blistering 14% rally in January that saw West Texas Intermediate (WTI) surge to multi-month highs near $67 per barrel, the benchmark has slid approximately 6% in

Via MarketMinute · February 6, 2026

LONDON — Shell, the British energy giant, reported its weakest quarterly profit in nearly five years on February 5, 2026, as a combination of cooling global oil prices and a protracted downturn in the chemicals market finally caught up with the company’s bottom line. The London-based major posted adjusted earnings

Via MarketMinute · February 6, 2026

Today’s Date: February 6, 2026 Introduction As of February 6, 2026, the global energy markets are recalibrating their expectations for the "Supermajors" after a turbulent start to the earnings season. At the center of this storm is Shell PLC (NYSE: SHEL), the London-based energy giant that has long served as a bellwether for the integrated [...]

Via Finterra · February 6, 2026

High-yield Chevron is built to be reliable in an industry known for volatility.

Via The Motley Fool · February 3, 2026

Exxon Mobil Corporation (NYSE: XOM) reported a blockbuster fourth-quarter earnings result on February 2, 2026, marking a historic year of operational milestones and financial dominance. The energy titan delivered an adjusted earnings per share (EPS) of $1.71, surpassing Wall Street’s consensus of $1.68, even as global energy

Via MarketMinute · February 2, 2026

Global energy markets were thrust into a state of high alert as February 2, 2026, dawned, with Brent crude oil surging to a multi-month peak of $71.00 per barrel. The spike followed a period of intense geopolitical friction, as a massive U.S. naval buildup in the Arabian Sea

Via MarketMinute · February 2, 2026

The books closed on 2025 with the global natural gas market presenting a striking study in regional contrast. While American consumers and industrial users grappled with a sharp 12.1% surge in Henry Hub prices during December, their counterparts in Europe and Australia enjoyed a surprising reprieve. The Dutch TTF,

Via MarketMinute · February 2, 2026

As of February 2, 2026, the European continent finds itself grappling with a familiar and chilling specter: an energy crunch that has seen natural gas storage levels plummet to their lowest levels since the 2022 crisis. After a series of deceptive winter "comfort zones" in 2023 and 2024, a combination

Via MarketMinute · February 2, 2026

In a year marked by a significant "lower for longer" pricing environment and shifting global energy dynamics, Chevron Corporation (NYSE: CVX) reported a resilient fourth-quarter 2025 performance that exceeded analyst expectations on the bottom line. Despite facing a sharp decline in average Brent crude prices—averaging $69 per barrel in

Via MarketMinute · January 30, 2026

IRVING, TX — In a display of operational muscle that has become the hallmark of its post-merger era, Exxon Mobil Corporation (NYSE:XOM) reported fourth-quarter 2025 earnings today that comfortably cleared Wall Street’s hurdles. Despite a challenging environment characterized by a nearly 20% year-over-year slide in global crude prices and

Via MarketMinute · January 30, 2026

SAN RAMON, CA — Chevron Corporation (NYSE: CVX) reported its fourth-quarter 2025 financial results this morning, delivering an earnings surprise that has caught Wall Street's attention. Despite a backdrop of cooling global oil prices and a year-over-year dip in total revenue, the energy giant managed to beat analyst expectations on the

Via MarketMinute · January 30, 2026

IRVING, Texas — Exxon Mobil (NYSE: XOM) delivered a resounding message to the energy markets on Friday, January 30, 2026, reporting fourth-quarter 2025 earnings that surpassed Wall Street expectations. The oil giant’s performance was anchored by a massive surge in domestic oil and gas production, particularly in the Permian Basin,

Via MarketMinute · January 30, 2026

As the final quarterly reports for 2025 filter through the financial markets this January 30, 2026, a striking paradox has emerged for the titans of American energy. ExxonMobil (NYSE:XOM) and Chevron (NYSE:CVX) have both reported all-time record production levels, flooding the market with oil from the Permian Basin

Via MarketMinute · January 30, 2026

As of January 30, 2026, the global energy landscape is witnessing a profound structural shift. While the world is currently awash in crude oil due to record production from non-OPEC+ sources, the ability to turn that raw material into usable fuels and chemicals has become the market's primary bottleneck. This

Via MarketMinute · January 30, 2026

The European Union’s ambitious roadmap toward a carbon-neutral continent has hit a significant roadblock as 2026 begins: a structural "feedstock crunch" that is driving price volatility across agricultural and waste-based commodity markets. As the ReFuelEU Aviation mandate—which required a 2% sustainable aviation fuel (SAF) blend starting in 2025—

Via MarketMinute · January 28, 2026