Exxon Mobil (XOM)

146.19

-2.26 (-1.52%)

NYSE · Last Trade: Feb 17th, 11:13 PM EST

The opening weeks of 2026 have witnessed a tectonic shift in global capital markets, marking what analysts are calling the "Great Sector Rotation." After three years of relentless dominance by artificial intelligence and cloud computing giants, the tide has abruptly turned. Investors are staging a massive exodus from high-multiple Software-as-a-Service

Via MarketMinute · February 17, 2026

NextEra Energy is helping accelerate data center developments.

Via The Motley Fool · February 17, 2026

As of February 17, 2026, the euphoria that pushed the S&P 500 to the brink of the historic 7,000 mark has been replaced by a growing sense of trepidation. Following a series of stern warnings from top Wall Street technical analysts last week, investors are bracing for what

Via MarketMinute · February 17, 2026

GENEVA, Switzerland — Global energy markets and geopolitical alliances are recalibrating following a high-stakes diplomatic breakthrough in Switzerland. On February 16, 2026, delegations from the United States and Iran resumed formal indirect negotiations aimed at de-escalating a multi-year nuclear standoff and dismantling the "maximum pressure" sanctions framework that has throttled Iranian

Via MarketMinute · February 17, 2026

In a move that has sent shockwaves through global capitals and commodity markets, the Trump administration has officially implemented a sweeping 25% tariff on any nation that continues to maintain trade relations with the Islamic Republic of Iran. Announced in early February 2026, this "Secondary Tariff" policy marks a fundamental

Via MarketMinute · February 17, 2026

The U.S. labor and consumer markets received a pivotal update this week as the Bureau of Labor Statistics released the January 2026 Consumer Price Index (CPI) report. Headline inflation cooled to a 2.4% annual rate, marking the lowest level of price growth since mid-2021 and coming in slightly

Via MarketMinute · February 17, 2026

As of February 17, 2026, Occidental Petroleum (NYSE: OXY) stands at a pivotal crossroads in its century-long history. Known traditionally as a Permian Basin powerhouse, the company is aggressively rebranding itself as a leader in the global energy transition. With its fourth-quarter 2025 earnings report scheduled for release tomorrow, February 18, all eyes are on [...]

Via Finterra · February 17, 2026

As of February 17, 2026, Texas Pacific Land Corporation (NYSE: TPL) stands as one of the most unique and profitable entities in the American energy landscape. Often described as a "land bank" or a "perpetual royalty machine," TPL has recently captured the market's attention with a significant 5.08% stock gain on February 13, 2026. This [...]

Via Finterra · February 17, 2026

The natural gas market faced a decisive technical breakdown today, February 17, 2026, as prices officially breached the long-held $3.20 per million British thermal units (MMBtu) support level. A combination of unseasonably warm weather forecasts and a federal storage report that failed to meet market expectations has sent the

Via MarketMinute · February 17, 2026

In a move that has fundamentally recalibrated the global energy landscape, the United States has aggressively eased its long-standing sanctions on Venezuela’s oil and gas sectors. As of February 17, 2026, the transition from a policy of "maximum pressure" to one of strategic reconstruction is in full swing, allowing

Via MarketMinute · February 17, 2026

LONDON/NEW YORK — February 17, 2026 — Global energy markets are currently suspended in a delicate balancing act as the Islamic Revolutionary Guard Corps (IRGC) concludes its "Smart Control of the Strait of Hormuz" naval exercises. The drills, which included the temporary closure of sections of the world’s most vital

Via MarketMinute · February 17, 2026

The United States and Canada are top oil and gas producers, which bodes well for these energy giants and their shareholders.

Via The Motley Fool · February 17, 2026

On Friday, February 13, 2026, the fragility of a highly concentrated stock market was laid bare as a 2.2% decline in Nvidia (NASDAQ:NVDA) single-handedly erased gains across dozens of other sectors. As the heaviest weighted company in the S&P 500 (NYSEARCA:SPY), Nvidia’s retreat acted as

Via MarketMinute · February 16, 2026

The first quarter of 2026 has delivered a stunning reversal of fortune for the global energy sector. After three grueling years of earnings contraction and market apathy, the sector exploded out of the gate in January 2026, posting a massive 14% gain that catapulted it to the top of the

Via MarketMinute · February 16, 2026

In a watershed moment for global equity markets, the S&P 500 (INDEXSP:.INX) briefly conquered the psychological 7,000-point milestone in late January 2026, marking the fastest 1,000-point ascent in the index's history. This historic peak, driven by a relentless "melt-up" in Artificial Intelligence (AI) valuations, saw the

Via MarketMinute · February 16, 2026

In a move that has sent shockwaves through the Houston energy corridor and solidified the 2026 "merger mania" trend, Devon Energy (NYSE:DVN) and Coterra Energy (NYSE:CTRA) officially announced a definitive agreement to merge in an all-stock transaction valued at $26 billion. The deal, revealed earlier this month on

Via MarketMinute · February 16, 2026

In early 2026, the global energy landscape is witnessing a structural transformation as the legendary U.S. shale boom—the force that upended global oil markets for over a decade—has finally hit a definitive plateau. As of February 16, 2026, latest data from the Energy Information Administration (EIA) confirms

Via MarketMinute · February 16, 2026

Energy stocks like Exxon and Chevron are generating massive cash flows, yet still trade at deep discounts to the broader market.

Via Benzinga · February 16, 2026

As of February 16, 2026, the global energy market finds itself trapped in a violent "tug-of-war" between gravity-defying geopolitical tensions and a relentless structural supply glut. While the International Energy Agency (IEA) has sounded the alarm on a massive projected surplus of nearly 4 million barrels per day (bpd) for

Via MarketMinute · February 16, 2026

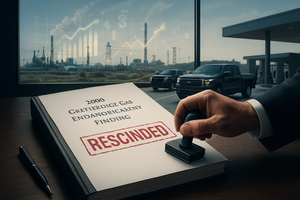

In a move that has sent shockwaves through the global automotive and energy markets, the Environmental Protection Agency (EPA) finalized a rule on February 12, 2026, rescinding the landmark 2009 Greenhouse Gas Endangerment Finding. This historic decision effectively dismantles the legal foundation for federal greenhouse gas (GHG) regulations under the

Via MarketMinute · February 16, 2026

In a decisive move that has sent shockwaves through global energy markets, Saudi Arabia has officially abandoned its long-held, unofficial target of $100 per barrel for crude oil. By mid-February 2026, the Kingdom has fully pivoted toward a "volume over value" strategy, signaling a willingness to endure lower prices in

Via MarketMinute · February 16, 2026

Energy markets were jolted into a high-volatility state this month as West Texas Intermediate (WTI) crude surged to the $65.00 mark, driven by the abrupt cancellation of high-stakes nuclear negotiations between Washington and Tehran. The talks, which were scheduled to take place in Istanbul, Turkey, fell apart after a

Via MarketMinute · February 16, 2026

The energy sector has soared in 2026, surprising many analysts.

Via The Motley Fool · February 14, 2026

In a move that signals the final stage of a multi-year consolidation wave in the American energy sector, Devon Energy (NYSE: DVN) and Coterra Energy (NYSE: CTRA) announced a definitive $58 billion all-stock merger on February 2, 2026. This blockbuster transaction, framed as a "merger of equals," creates a premier

Via MarketMinute · February 13, 2026